Welcome to MarketBites! Here's all you need to know about yesterday's market news.

"To live is the rarest thing in the world. Most people exist, that is all.”

- Oscar Wilde

PORTFOLIO MANAGER COMMENTARY

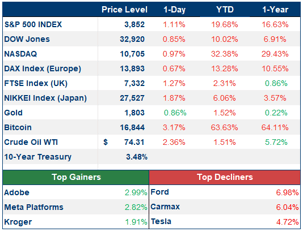

Stocks dropped Friday, building on their year-end sell-off, as fears grow over a recession taking place as the Federal Reserve continues raising rates. The marks a second consecutive week of losses for the major indexes. The S&P 500 fell 2.08% for the week, and putting its December losses at 5.58%, as hopes for a year-end rally fizzle. The Dow and Nasdaq slid 1.7% and 2.7%, respectively.

Trading was especially volatile Friday with a large amount of options expiring. There were $2.6 trillion worth of index options expiring, the highest amount “relative to the size of the equity market in nearly two years,” according to Goldman Sachs.

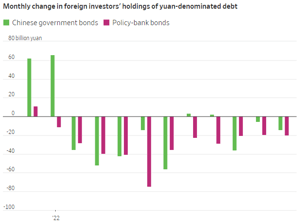

CHART OF THE DAY

International investors dumped a net $7 billion of yuan-denominated bonds in November, continuing a 10-month pullback from the Chinese domestic bond market, according to data from two major clearinghouses in China. In total, foreign investors have cut their Chinese bond holdings by $106 billion since February, the same month Russia invaded Ukraine. The rise in U.S. interest rates is a big factor. Despite a jump in Chinese bond yields in recent weeks, 10-year Chinese government bonds still yield roughly 0.6 percentage point less than U.S. Treasurys.