Welcome to MarketBites! Here's all you need to know about yesterday's market news.

“Perfection is not attainable. But if we chase perfection we can catch excellence."

- Vince Lombardi

PORTFOLIO MANAGER COMMENTARY

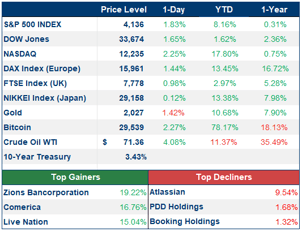

Stocks popped on Friday as regional bank shares climbed off their lows and market-darling Apple reported better-than-expected quarterly earnings. Stocks rose even as April’s jobs numbers came in hotter than expected. The U.S. economy added 253,000 jobs in April, while Wall Street had expected 180,000 new jobs, according to the Bureau of Labor Statistics. This data could signal that the Fed's rate hiking campaign may last longer than previously expected. Meanwhile, Apple posted beats on the top and bottom lines for Q2, propelled by iPhone sales. Apple shares gained 4.6%.

The rebound for regional bank stocks was boosted by a note from JPMorgan, which upgraded Western Alliance, Zions Bancorp and Comerica to overweight. The firm said those three banks appear “substantially mispriced” in part due to short-selling activity. The SPDR S&P Regional Banking ETF (KRE) advanced 6.5%. PacWest — which is down sharply this week on news it’s considering strategic options that include a sale — popped 83.8%. Western Alliance also jumped 45.1%.

Shares of regional banking companies have been under pressure this week, as traders fear other institutions could suffer the same fate as Silicon Valley Bank and Signature Bank. Both banks collapsed in March.

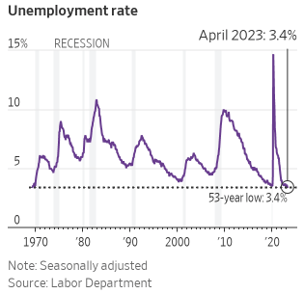

CHART OF THE DAY

Hiring strengthened in April, showing the job market is resilient despite banking turmoil, rising interest rates, and high inflation. Employers added 253,000 jobs in April, the best gain since January, the Labor Department said Friday. The jobless rate fell to 3.4% last month, matching the lowest reading since 1969. Last month’s job growth suggests the labor market remains a pillar of strength in a cooling economy. The economy grew more slowly to start the year versus the end of 2022 as businesses cut back on investments, while the housing market remained weak. Many economists forecast the U.S. to slip into recession in the next 12 months.