Welcome to MarketBites! Here's all you need to know about yesterday's market news.

“The pessimist sees difficulty in every opportunity. The optimist sees opportunity in every difficulty."

- Winston Churchill

.png?width=303&height=225&name=image%20(22).png)

PORTFOLIO MANAGER COMMENTARY

Stocks fell Wednesday after the Federal Reserve raised rates by 25 basis points, as was widely expected. Earlier bullish sentiment was dented somewhat after Fed Chair Jerome Powell ruled out cutting interest rates because he did not expect inflation to come down quickly enough. “In determining the extent to which additional policy firming may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments,” the Fed said in a statement.

However, traders noticed what the Fed didn’t say this time in its post-meeting statement. The central bank appeared to soften its language about future rate increases by dropping a line from the March statement that said, “the Committee anticipates that some additional policy firming may be appropriate.” Powell commented to the press after the statement’s release that dropping that language was a “meaningful change” and that the central bank’s June decision would be driven by incoming data.

Meanwhile, the banking sector continued to drop. The SPDR S&P Regional Banking ETF (KRE) declined more than 1%. The regional banking ETF fell more than 6% during Tuesday’s trading session. Shares of PacWest shed nearly 2% after losing about 28% the prior day. Western Alliance shares were down 4.4%.

CHART OF THE DAY

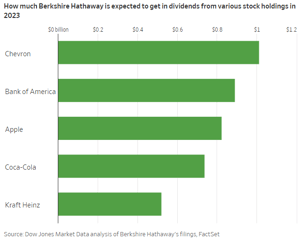

One reason Warren Buffett's stock portfolio has been so successful over time is an uncanny knack for picking good businesses. Another, according to Mr. Buffett, is something more understated: an appreciation of dividend-paying stocks. Dividend stocks are shares of companies that regularly return a portion of their earnings to shareholders, typically in the form of cash. The majority of companies that Mr. Buffett invests in pay out dividends. In fact, this year Mr. Buffett’s Berkshire Hathaway is expected to rake in about $5.7 billion in cash from its stock portfolio, according to an analysis of company filings conducted by Dow Jones Market Data.

Nearly a fifth of that money will come from Chevron, which last year became one of Berkshire’s biggest stockholdings. The oil producer has increased its dividends for 36 consecutive years. Berkshire is also poised to collect more than $700 million apiece from Coca-Cola, Apple, and

“That’s what he loves: dividends and buybacks,” said Todd Finkle, a professor of entrepreneurship at Gonzaga University and author of a book about Mr. Buffett’s career.