Welcome to MarketBites! Here's all you need to know about yesterday's market news.

“Every day is a bank account, and time is our currency. No one is rich, no one is poor, we've got 24 hours each."

- Christopher Rice

.png?width=305&height=230&name=image%20(21).png)

PORTFOLIO MANAGER COMMENTARY

Stocks tumbled on Tuesday as traders’ fears around contagion in the regional banking sector returned ahead of the Federal Reserve’s rate decision. Bank shares slid, with the SPDR S&P Regional Banking ETF dropping more than 6%. Traders questioned the stability of smaller regional financial institutions after the crisis that engulfed Wall Street in March and brought about the end of Silicon Valley Bank and First Republic Bank. Regional banks PacWest and Western Alliance declined 27% and 15%, respectively. Meanwhile, JPMorgan Chase’s shares shed 1.6%, giving back some of its gains from Monday after the FRB takeover.

“We think that the concerns around the bank sector, combined with uneasiness regarding the debt ceiling — and most importantly, apprehension over the uncertain future Fed rate policy stance — are all contributing to this risk-off sentiment. So in an area like the bank sector that already was under stress, we’re also seeing greater unease because of these other contributing factors,” said Greg Bassuk, CEO of AXS Investments.

The Fed’s two-day policy meeting, which kicked off yesterday, is expected to conclude with the central bank announcing another quarter-point rate hike later today. Per the CME Group’s FedWatch tool, traders are pricing in a roughly 85% chance of a rate hike.

CHART OF THE DAY

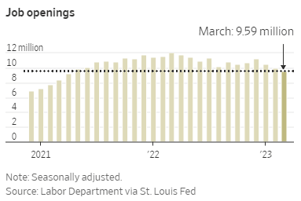

U.S. job openings dropped to their lowest level in nearly two years in March and layoffs rose sharply, in signs that demand for workers is cooling a year after the Federal Reserve began lifting interest rates to combat inflation. Employers reported a seasonally adjusted 9.59 million job openings in March, the Labor Department said Tuesday, a decrease from a revised 10 million openings in February. This is the lowest level of job openings since April 2021. Down from a record 13 million recorded in March one year ago.