Welcome to MarketBites! Here's all you need to know about yesterday's market news.

“When anger rises, think of the consequences."

- Confucious

.png?width=303&height=229&name=image%20(23).png)

PORTFOLIO MANAGER COMMENTARY

Stocks declined Thursday, as contagion fears in the regional bank space were reignited. The Dow turned negative for the year on Thursday, pulling back 0.06% year to date. Declines in Boeing, Disney, Goldman Sachs, and American Express shares dragged on the Dow. Regional bank stocks continue to slide on Thursday with PacWest leading the way down 50%. The decline came after news late Wednesday that the California bank has been assessing strategic options, including a possible sale, a person familiar told CNBC.

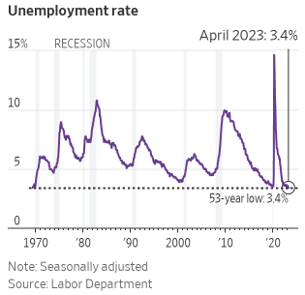

Investors also digested the Federal Reserve’s 25 basis point rate hike and commentary following its Wednesday meeting. Keith Apton, managing director at UBS Wealth Management, said that the volatility in the banking sector will help the Fed’s mission of cooling down the economy. More data on the economy is due this morning at 8:30 AM when April's nonfarm payrolls report is due, as well as numbers of the unemployment rate.

CHART OF THE DAY

Foreign direct investment flows into China dropped by 48% from a year earlier, hitting the lowest level in five years as Covid-19 lockdowns mauled its economy, while other gauges suggest the world’s second-largest economy is struggling to attract corporate newcomers. China continues to attract a sizable share of global investment, but the increases in the money flowing in haven’t kept pace with the expansion in China’s economy and are a far cry from the investment growth that followed Beijing’s accession to the World Trade Organization two decades ago. Rising tensions with the U.S. threaten to restrain investments, with the Biden administration readying new curbs on American investment into China.