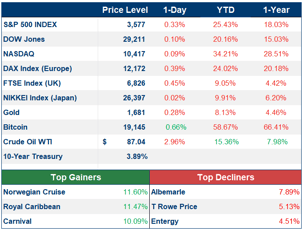

Welcome to MarketBites! Here's all you need to know about yesterday's market news.

“I don’t know the word ‘quit’”

- Susan Butcher

PORTFOLIO MANAGER COMMENTARY

The stock market didn't move much on Wednesday as investors brace for today's inflation reading. This inflation reading is especially significant because this is the last major data point before the Federal Reserve meets next month to decide the next round of rate hikes. Economists expect year-over-year CPI for September to come in at 8.1% slightly lower than the 8.3% increase in August.

Data Wednesday showed prices paid to U.S. producers rose in September at a higher rate than expected. This could be a sign of caution heading into today's inflation data.

Overseas, the turmoil in the U.K. continued with 30-year bonds (gilts) surging above 5%. As of right now, the Bank of England remains firm on not providing more assistance to the market after this Friday.

On the earnings front, Pepsi surged after lifting its forecast for the year on the back of better-than-estimated Q3 profits. JPMorgan, Wells Fargo, Morgan Stanley, and Citigroup will report on Friday.

Investment Analyst

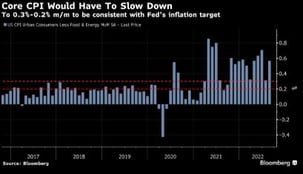

CHART OF THE DAY

Expectations are that core inflation (excluding food and energy) will come in at a 0.4% month-over-month rate in September. The red lines between 0.3% and 0.2% on the chart show where the Federal Reserve would feel more comfortable with month-over-month changes in inflation.

By Raymond Kanyo

Investment Analyst