Welcome to MarketBites! Here's all you need to know about yesterday's market news.

“Knowledge is knowing that a tomato is a fruit. Wisdom is not putting it in a fruit salad.”

- Miles Kington

PORTFOLIO MANAGER COMMENTARY

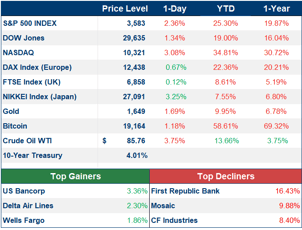

Markets fell on Friday to close out the week with a loss. Friday's negative movement was a sharp reversal from Thursday's big rally. While it is hard to explain Thursday's rally, Friday's price action was more in line with recent economic data pointing to stubbornly high inflation. The latest inflation update came from a University of Michigan survey that showed 1-year out inflation expectations rising from 4.6% to 5.1%.

After digesting the inflation news, Wall Street expects that interest rates will rise to as high as 4.9% by the end of 2023.

On the earnings front, JPMorgan and Wells Fargo came in strong, while Morgan Stanley disappointed. Next week, Bank of America, Goldman Sachs, Johnson & Johnson, Netflix, Tesla, and United Airlines are some of the blue-chip earnings to watch.

Investment Analyst

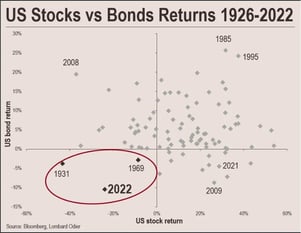

CHART OF THE DAY

2022 is shaping up to be one of the worst years for the stock market. However, it is important to note that between 1931-2022 and 1969-2022 the S&P 500 annualized 10.71% and 10.31% respectively.

By Raymond Kanyo

Investment Analyst