Welcome to MarketBites! Here's all you need to know about yesterday's market news.

“As we get older, we become smarter and we gradually realize that a $30 watch and a $300 watch show the same time."

- Steve Jobs

PORTFOLIO MANAGER COMMENTARY

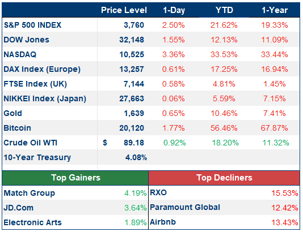

The Fed raised interest rates by 75 basis points yesterday to combat persistent inflation sending markets spiraling downwards. The Nasdaq led the major indices down, falling 3.36%. Selling picked up in the afternoon as Jerome Powell was finishing up his speech. The central bank signaled towards plans to keep raising rates, though possibly in smaller increments.

During his speech Powell noted that “We still have some ways to go and incoming data since our last meeting suggests that the ultimate level of interest rates will be higher than previously expected.” And then he added it was “premature” to talk about pausing hikes, “we have a ways to go.”

Investment Analyst

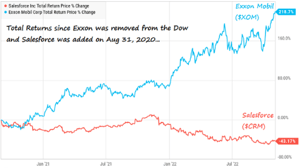

CHART OF THE DAY

The chart below highlights the glaring differences in stock performances after the first wave of the pandemic hit. After the initial selloff in March 2020, people began pouring money into tech companies that have now been getting hit the hardest over the past year. Meanwhile, other sectors like energy had performed poorly early on before coming back in a big way. The large performance differences caused the Dow to kick off Exxon Mobile, a stock that had been in the index for 92 years, for Salesforce, a software company that is now down 50% over the past year.