Welcome to MarketBites! Here's all you need to know about yesterday's market news.

“If you are not willing to risk the usual, you will have to settle for the ordinary."

-Jim Rohn

.png?width=300&height=226&name=image%20(9).png)

PORTFOLIO MANAGER COMMENTARY

The Nasdaq Composite fell on Wednesday for a third-straight day as investors shifted away from growth stocks amid signs that the U.S. economy is weakening. These moves came as traders mulled over the latest ADP private payrolls report, which showed slowing job growth in March. That followed Tuesday’s job openings report that suggested the Federal Reserve’s efforts to cool the labor market might finally be having an effect. In February, the number of available positions fell below 10 million for the first time in nearly two years.

High-growth tech stocks were under pressure on Wednesday, with Zscaler and CrowdStrike falling 8.3% and 6.6%, respectively. Chip stocks were also under pressure, with Advanced Micro Devices falling more than 3%. The defensive tilt of the market helped health care stocks outperform, boosting the Dow. Johnson & Johnson shares rose 4.5% after the pharmaceutical company said Tuesday it would pay $8.9 billion over the next 25 years to settle claims that its talc products caused cancer. Utilities stocks also outperformed.

U.S. Treasury yields fell yesterday, but the potential for further rate hikes from central banks is contributing to market volatility. New Zealand’s central bank overnight hiked rates by 50 basis points, noting that inflation was “too high and persistent.” Meanwhile, Cleveland Fed President Loretta Mester said Tuesday night that she thought the U.S. central bank still needs to raise rates further.

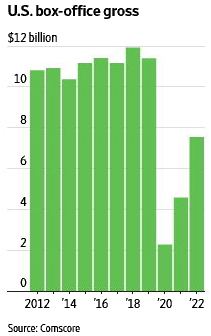

CHART OF THE DAY

Despite the partial rebound in ticket sales from their lows during the worst days of Covid-19 shutdowns, the lingering disruption to film production and growing adoption of streaming services have subjected movie theater operators to punishing market conditions. For example, AMC Entertainment Holdings Inc., which had a market capitalization of more than $31 billion at the height of its meme-stock hype, is now worth a fraction of that after years of burning cash from operations. And the nation’s largest movie-theater advertisement company, National CineMedia Inc., is on the brink of bankruptcy. The domestic box office amounted to $7.54 billion in 2022, up substantially from the pandemic trough of $2.28 billion in 2020, according to data from Comscore Inc., a media research and analytics firm. The industry is expected to recover further to roughly $8.5 billion to $9.5 billion in 2023. But it would still be a far cry from the $11.4 billion in 2019, the last year before the virus hit the U.S., Comscore data show.

WHAT ELSE IS HAPPENING

- Inside the infamous Russian prison holding Evan Gershkovich - read here

- FedEx restructures to combine ground and express delivery networks - read here

- Exxon quits drilling in Brazil after failing to find oil - read here