Welcome to MarketBites! Here's all you need to know about yesterday's market news.

“If you want to lift yourself up, lift up someone else."

-Booker T Washington

.png?width=300&height=227&name=image%20(164).png)

PORTFOLIO MANAGER COMMENTARY

Tech stocks lifted the S&P 500 into the green Thursday as the market attempted to wrap up the short trading week on a high note. The S&P 500 still lost 0.1% on the week, posting its first losing week in four. The tech-heavy Nasdaq fell 1.1% this week, while the 30-stock Dow rose 0.6%.

The market remained volatile as the latest weekly jobless claims came in higher than expected, adding to recent signals that pointed to slowing job growth. The expansion in private payrolls was well below expectations in March, ADP said earlier this week. Meanwhile, the number of available positions fell below 10 million in February — a first in almost two years. Job cuts have also soared by nearly fivefold so far this year from a year ago.

Over the past several months, investors had cheered signs of economic cooling on the hope that it could push the Federal Reserve to change course on its interest rate hiking campaign. But they are now wondering if the central bank has gone too far in its bid to cool inflation, tightening the economy to the point of a recession.

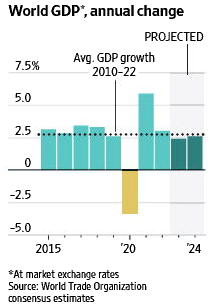

CHART OF THE DAY

GDP growth is expected to fall below its 12-year average in 2023, before improving in 2024. This hindrance is being caused by the war in Ukraine and stubborn inflation around the globe. These two factors are restraining the pace of economic recovery even as the world emerges from the height of the pandemic. Inflation is a big culprit of sluggish trade growth, World Trade Organization economists say. While food and energy prices have declined from their sharply elevated levels following Russia’s invasion of Ukraine in early 2022, they remain higher than before the war, eroding people’s income and demand for imported goods. That has cooled global commercial activities, particularly in the fourth quarter of 2022.

WHAT ELSE IS HAPPENING

- The 10 busiest airports in the world - read here

- As national park visits surge, consulting firm benefits - read here

- Investors retreat from commercial real estate bonds - read here