Welcome to MarketBites! Here's all you need to about yesterday's market news.

Quote of the day:

"Play by the rules, but be ferocious."

- Phil Knight

PORTFOLIO MANAGER COMMENTARY

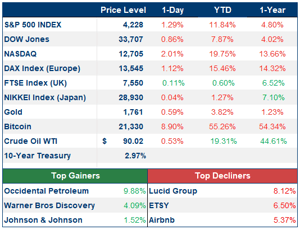

U.S. stocks had a rough end to the week with all three indexes finishing lower. The S&P 500 declined -1.26%, the Dow slid -0.84%, and the Nasdaq finished in last place at -1.96%.

All eyes were on the Fed yesterday, as officials suggested the central bank could maintain a rapid pace of interest-rate raises. The news caused investors to second-guess their previous assumptions about how aggressive Fed policy could be moving forward.

The WSJ Dollar Index increased 0.6% on Friday. The dollar is on pace for its largest one-week percentage increase since March 2020 according to Dow Jones Market Data. Higher interest rates tend to bolster U.S. dollars as yield-seeking investors pour more money into U.S. dollar-denominated securities.

Meme stocks had an atrocious trading session, with shares of Bed Bath & Beyond dropping -40% after activist investor Ryan Cohen sold his 10% stake in the company. GameStop and AMC Entertainment also had poor days, falling -7.2% and -6.7%, respectively.

CHART OF THE DAY

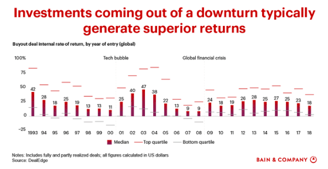

New research conducted by DealEdge found that investments made by private equity firms during recovery years have consistently outperformed the long-term averages.

Investment Analyst

WHAT ELSE IS HAPPENING

- HBO Max pulls dozens of core programs - (read here)

- Theaters continue to lag - (read here)

- Biotech has the buzz - (read here)

- Bitcoin falls below 22K - (read here)