Welcome to MarketBites! Here's all you need to know about yesterday's market news.

“Small minds and weak people kill big dreams."

- David Goggins

.png?width=301&height=224&name=image%20(158).png)

PORTFOLIO MANAGER COMMENTARY

The S&P 500 rose Thursday, as investors bet the worst of the regional bank crisis has passed. The index rose 0.5% to its highest since March 7, bringing its gain 6% from the benchmark’s March low during the height of bank fears. The Nasdaq also gained as tech stocks saw continued investor interest. Market volatility has been dropping as of late. The Cboe Volatility Index, a preferred measure of how turbulent the S&P 500 will be over the next 30 days, has pulled back to the 19 level after reaching 30 in the middle of March. Meaning Wall Street’s fear gauge is back to where it was when the month began.

In economic news, weekly jobless claims increased by 7,000 to 198,000, adding to hopes that the Federal Reserve could slow down its tightening campaign because the labor market is cooling.

For the month, the Nasdaq Composite is up more than 4% while the S&P 500 has gained nearly 2% as investors shook off the collapse of Silicon Valley Bank and yet another rate increase from the Fed.

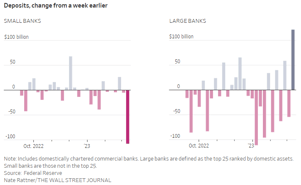

CHART OF THE DAY

The 25 biggest U.S. banks gained $120 billion in deposits in the days after SVB collapsed, according to Federal Reserve data. All the banks outside of the 25 largest lost $108 billion over the same period. It was the largest weekly decline in smaller banks' deposits in dollar terms on record. The panics have subsided, but the deposit swings could have long-lasting repercussions for the communities served by smaller banks. "If we lose that deposit base to the money-center banks, we can't grow and lend out future dollars," said Brian Johnson, CEO of North Dakota's Choice Bank. "Communities can't grow, and businesses can't profit."

WHAT ELSE IS HAPPENING

- Russia detains WSJ reporter on espionage allegations - read here

- Musk's moves to monetize Twitter's blue check mark irks celebs - read here

- Political uncertainty in Taiwan adds to U.S.-China tensions - read here