Welcome to MarketBites! Here's all you need to know about yesterday's market news.

“Making a product is just an activity, making a profit on a product is the achievement."

- Amit Kalantri

MARKET PERFORMANCE

.png?width=303&height=228&name=image%20(130).png)

PORTFOLIO MANAGER COMMENTARY

The Dow Jones Average fell Wednesday as concern over a banking crisis spreading to Europe pressured the broader market. The indexes regained some ground in afternoon trading following an announcement from a Swiss regulator that the country’s central bank would give Credit Suisse liquidity if necessary. Investors were concerned after the Saudi National Bank, Credit Suisse’s largest investor, said it could not provide any more funding.

The news came after the Swiss lender said earlier this week it had found “certain material weaknesses in our internal control over financial reporting” for the years 2021 and 2022. U.S.-listed shares of Credit Suisse closed nearly 14% lower. “We’re seeing the bank turmoil that started in Silicon Valley, it’s really spreading across the globe,” said Edward Moya, senior market analyst at Oanda. “The markets are realizing that you’re seeing the banks are in trouble because a lot of their profitability models have been based on, for the most part, zero-interest rates.”

U.S. big bank shares declined in sympathy with Credit Suisse and the the European Bank sector. Citigroup slid 5.4%, while Wells Fargo and Goldman Sachs each lost more than 3%. The Financial Select Sector SPDR Fund (XLF) lost 2.7%.

CHART OF THE DAY

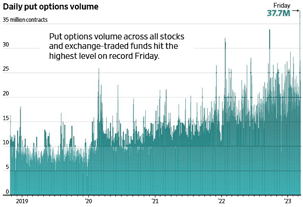

Investors are scrambling to protect against the possibility of a protracted stock-market downturn. The collapse of three banks in the past week exacerbated recent volatility that crested through stock, bond and derivatives markets. Many traders are reaching for bets that would pay out if the haywire stretch for markets continues. Put options volume across all stocks and exchange-traded funds hit the highest level on record Friday, according to Cboe Global Markets data going back to 1973, the listed-options market’s inception. Such contracts give investors the right to sell shares at a specific price, by a stated date. They can be used to hedge portfolios, like stock insurance, or bet on bigger declines. Other traders are seeking shelter in traditionally safer assets, such as government bonds and gold, or bracing for more stress in the broader banking sector.

WHAT ELSE IS HAPPENING

- A Chinese businessman charged in alleged $1B fraud conspiracy - read here

- Why gas bills are going crazy - with no end in sight - read here

- Boeing's legal dispute - read here