Welcome to MarketBites! Here's all you need to know about yesterday's market news.

“A successful person never loses… they either win or learn!"

- John Calipari

MARKET PERFORMANCE

.png?width=300&height=226&name=image%20(136).png)

PORTFOLIO MANAGER COMMENTARY

Stocks fell Friday as investors pulled back from positions in First Republic and other bank shares amid lingering concerns over the state of the U.S. banking sector. First Republic slid nearly 33% to end the week down close to 72%. That marked a turn from Thursday’s relief bounce, which came when a group of banks said it would aid First Republic with $30 billion in deposits as a sign of confidence in the banking system. Friday’s nosedive weighed on the SPDR Regional Banking ETF (KRE), which lost 6% in the session and finished the week 14% lower.

U.S.-listed shares of Credit Suisse closed down nearly 7% as traders parsed through the bank’s announcement that it would borrow up to $50 billion francs, or nearly $54 billion, from the Swiss National Bank. The stock lost 24% over the course of the week.

Despite the down session, the S&P 500 has advanced 1.43% in the week. The Nasdaq Composite gained 4.41% as investors bet on technology and other growth names ahead of next week’s Federal Reserve policy meeting. But Friday’s slide pulled the Dow into negative territory for the week, finishing 0.15% down.

Next week the Federal Reserve is meeting on March 21-22. The question on the minds of traders is whether the central bank will proceed with an expected 25 basis point hike even as banking woes whiplash the market.

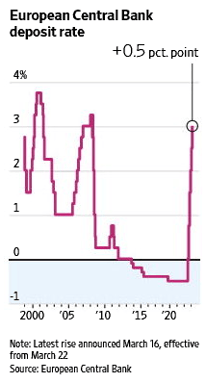

CHART OF THE DAY

The European Central Bank raised interest rates by a half percentage point while promising emergency support for eurozone banks if needed, showing the policy makers’ balancing act as they seek to combat high inflation without aggravating strains in the financial system. The ECB said in a statement that it would increase its key rate to 3%, following half-point rate increases in February and December. The half-point rise surprised analysts who had expected a smaller uptick given the tense market situation after the collapse of Silicon Valley Bank.

WHAT ELSE IS HAPPENING

- ICC issues an arrest warrant for Putin - read here

- GE cancels stock awards for CEO, cutting pay $14 million - read here

- Army forges cannons for digital era at steam-age arsenal - read here