Welcome to MarketBites! Here's all you need to know about yesterday's market news.

"Rich people have small TVs and big libraries, and poor people have small libraries and big TVs.”

- Zig Ziglar

PORTFOLIO MANAGER COMMENTARY

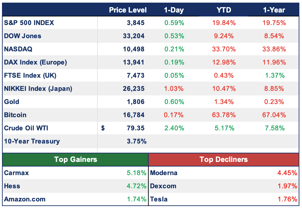

The S&P 500 and Nasdaq Composite rose Friday, but still posted a weekly loss as recession fears continue to worsen investor sentiment. The major indexes were volatile earlier in the session after the core personal consumption expenditures price index, the Federal Reserve’s preferred gauge of inflation, came in right around what economists expected on a year-over-year basis, indicating that inflation is sticking despite the Fed’s efforts to fight it.

Recession fears have resurged recently dashing some investors’ hope for a year-end rally and leading to big losses in December. Investors worry that overtightening from central banks worldwide could force the economy into a downturn.

For December, the S&P 500 has lost 5.8%, while the Dow and Nasdaq have lost more than 4% and 8.5%, respectively. Those are the biggest monthly declines for the major averages since September. Stocks are also on pace for their worst annual performance since 2008.

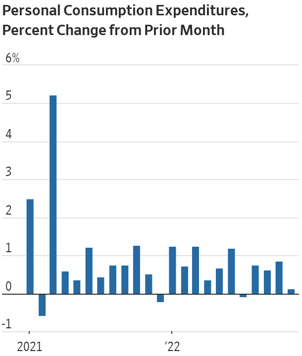

CHART OF THE DAY

The personal-consumption expenditures price index rose 5.5% in November from a year earlier, a significant cooling from 6.1% in October. The core PCE-price index, which removes volatile food and energy prices, rose 4.7% in November from a year earlier, compared with 5.0% in October. Lastly, on a month-to-month basis, the PCE-price index rose 0.1% in November from the prior month, compared with October’s 0.4% increase.