Welcome to MarketBites! Here's all you need to know about yesterday's market news.

"Life is what happens when you're busy making other plans.”

- John Lennon

PORTFOLIO MANAGER COMMENTARY

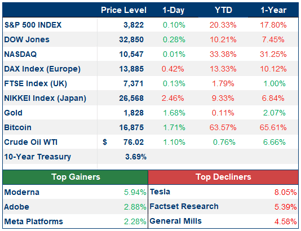

Stocks rose Tuesday as Wall Street contemplated a surprise move from the Bank of Japan to forgo their previously strict cap on interest rates, resulting in bond yields increasing globally. Investors also overlooked fears that a year-end rally may not come to pass.

Even with Tuesday’s gains, stocks are on track to end the week and month in the red. The Dow is down 5.03% month to date. In December, the S&P 500 has shed 6.34%, and the Nasdaq has lost 8.03%.

Looking ahead, this week will have lots of insight into the housing industry. Sales data for existing homes and new homes will be released today and Friday, respectively. Additionally, November’s personal consumption expenditures report, a preferred measure of inflation for the Fed, will be coming on Friday.

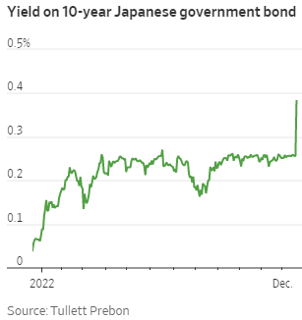

CHART OF THE DAY

The Bank of Japan made a surprise decision to let a benchmark interest rate rise to 0.5% from 0.25%, pushing the yen higher and ending a long period in which it was the only major developed-nation central bank not to increase rates. The 10-year yield, which had been stuck around 0.25% for months because of the central bank cap, quickly moved up to 0.40% in afternoon trading.