Welcome to MarketBites! Here's all you need to know about yesterday's market news.

"The secret of your future is hidden in your daily routine”

- Mike Murdock

PORTFOLIO MANAGER COMMENTARY

Stocks rose Tuesday as Wall Street looked past tightening Covid policies in China to instead focus on some strong earnings reports and the potential for smaller future rate hikes. Stocks were also helped by easing bond yields as investor attention turned toward 2023.

China saw its first deaths in the mainland from Covid since May over the weekend. It prompted fears among investors that the country could bring back restrictions meant to slow virus spread, which would hurt business. Just a week ago the country began to ease some of its tight covid measures, on its way to a looser policy. China reopening would be “extremely growth positive,” according to Seema Shah, chief global strategist at Principal Asset Management

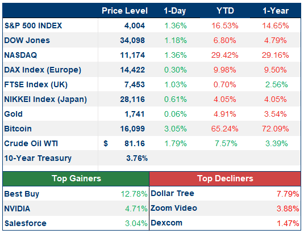

A batch of mixed earnings led to a few big stock moves. Best Buy popped 12.8% after the electronics retailer hiked its 2023 fiscal outlook and beat earnings expectations, while Abercrombie & Fitch and American Eagle Outfitters rose 19% and 16% respectively on their own earnings beats. On the contrary, Zoom fell 5.4% and Dollar Tree slipped about 9% after reporting disappointing earnings and a lower-than-expected outlook, respectively.

Lastly, oil prices rose after Saudi Arabia said that OPEC+ would stick with the output cuts it previously announced. Investors will be watching for economic reports coming out today including initial jobless claims and purchasing manager index numbers.

Investment Analyst

CHART OF THE DAY

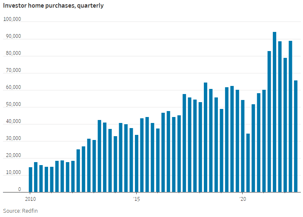

Investor buying of homes tumbled 30% in the third quarter, a sign that the rise in borrowing rates and high home prices that pushed traditional buyers to the sidelines are causing these firms to pull back, too. Companies bought around 66,000 homes in the 40 markets tracked by real-estate brokerage Redfin during the third quarter, compared with 94,000 homes during the same quarter a year ago. The percentage decline in investor purchases was the largest in a quarter since the subprime crisis, disregarding the second quarter of 2020 when the pandemic shut down most home buying.