Welcome to MarketBites! Here's all you need to know about yesterday's market news.

"There are no traffic jams on the extra mile.”

- Zig Ziglar

PORTFOLIO MANAGER COMMENTARY

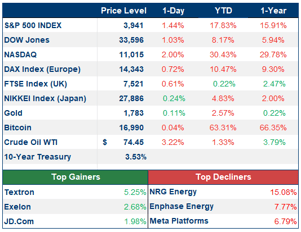

Stocks continued to fall on Tuesday as fears of a recession build. Media and bank stocks, which tend to suffer the most during a recession, led the decline. Oil prices kept falling, too, and are now in negative territory for 2022.

Paramount Global’s CEO warned of lower fourth-quarter advertising revenue, sending shares down nearly 7%. Morgan Stanley’s stock slumped amid news it’s planning to cut 2% of its workforce, continuing the recent layoff trend in the sector. Growth-focused technology names like Nvidia, Amazon and Meta Platforms also weighed on the market.

Markets are largely expecting the Federal Reserve to slow its hiking pace to a half-percentage-point increase when it meets next week. But investors fear a step down in its clip won’t be enough to stop the economy from entering a recession in 2023.

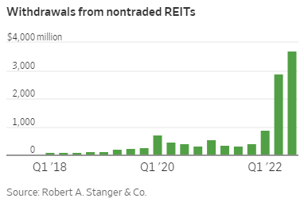

CHART OF THE DAY

Big and small investors are lining up to pull money out of real-estate funds in the latest sign that the surge in interest rates is threatening to upend the commercial-property sector. Blackstone Inc. last week said it would limit the amount of money investors could withdraw from its $69 billion flagship real-estate fund following a surge in redemption requests. The rise in redemption requests is still relatively small, and it could prove to be short-lived. Still, if the number of investors asking for their money back keeps growing, it would likely become a problem for the real-estate market. That is because funds that need to raise cash to pay back their investors often have no other choice but to sell buildings.