Welcome to MarketBites! Here's all you need to know about yesterday's market news.

“Your talent determines what you can do. Your motivation determines how much you’re willing to do. Your attitude determines how well you do it."

- Lou Holtz

.png?width=300&height=224&name=image%20(16).png)

PORTFOLIO MANAGER COMMENTARY

The S&P 500 finished little changed Wednesday as earnings season kicked into full swing and investors parsed the latest results from companies including Netflix and Morgan Stanley. Earnings from major banks institutions wrapped up with Morgan Stanley, gaining 0.7%. Despite strong results, the stock initially traded down as margins for its investment banking, wealth, and asset management businesses were weaker than expected, according to Wells Fargo analyst Mike Mayo.

So far this week, trading has been choppy as investors evaluate a rush of earnings. Wall Street this season is on the hunt for signs of weakening demand and conditions likely to put a damper on profitability into the back half of 2023.

"Overall, Q1 earnings may not move the needle much, in our view," said Barclays’ Emmanuel Cau. "However, stocks have rallied, but positioning remains cautious, so more earnings-driven upside would extend the pain trade."

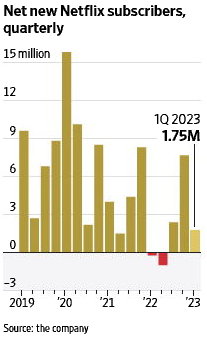

CHART OF THE DAY

Netflix added 1.75 million subscribers in the first quarter and ended the period with 232.5 million customers, a far slower pace of growth than it was accustomed to before and during the pandemic. In response, Netflix announced it would roll out new password-sharing limitations more broadly, including in the U.S., by the end of June. Programs to add subscribers, such as password-sharing limitations and their ad-supported tiers, began a year ago after the company lost subscribers for the first time in a decade. This is an important transition for Netflix since they estimate more than 100 million people use borrowed accounts.