Welcome to MarketBites! Here's all you need to about yesterday's market news.

Quote of the day:

"There is no hope of success for the person who does not have a central purpose, or definite goal at which to aim."

- Napoleon Hill

PORTFOLIO MANAGER COMMENTARY

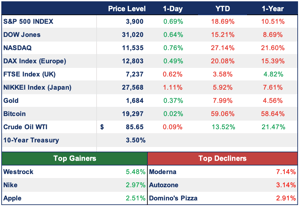

Markets pushed slightly higher to start the week on Monday ahead of the Fed’s two-day policy meeting. The S&P 500 increased 0.69%, the Nasdaq gained 0.76%, and the Dow rose 0.64%. Treasury yields continued to gain ahead of an expected rate hike of 75 basis points. The 10-year Treasury yield topped 3.51% yesterday which is its highest level in 11 years.

After brief hope over the summer that the Fed would loosen its aggressive tightening campaign, investors have been dumping stocks again over fear that the Fed will go too far and bring the economy into a recession. Most S&P sectors rose or traded flat on Monday with consumer discretionary, industrials, and materials leading the way. Financials also rose with investors hoping that higher rates will benefit their bottom lines.

Aside from the Fed policy meeting, watch out for key economic numbers such as August housing starts, and initial jobless claims coming on Thursday.

CHART OF THE DAY

As supply chain issues for container ship companies continue to persist in the post-pandemic world, many of these companies have expanded into using airfreight to keep up with deadlines. Airfreight, which used to be an 'expensive distraction', is now turning into a crucial component for supply chains.

Investment Analyst

WHAT ELSE IS HAPPENING

- Ford warns investors of $1B in extra costs - (read here)

- Homebuilders lower prices as optimism vanishes - (read here)

- Instacart focuses IPO on selling employee shares - (read here)

- VW sets price range for Porsche IPO - (read here)