Welcome to MarketBites! Here's all you need to know about yesterday's market news.

“The finest steel has to go through the hottest fire."

- Richard M. Nixon

.png?width=303&height=228&name=image%20(20).png)

PORTFOLIO MANAGER COMMENTARY

The Dow Jones average inched lower Monday in the wake of the government’s seizure of First Republic over the weekend and the bank’s subsequent sale to JPMorgan Chase. JPMorgan Chase shares rose 2.1% after it emerged as the winner of a weekend auction for First Republic Bank. The big bank has acquired all of troubled lender First Republic’s deposits and a “substantial majority of assets.” This deal means that JPMorgan Chase, already one of the biggest U.S. banks, will become even larger. JPMorgan Chase CEO Jamie Dimon said that the deal resolves much of the fallout in the banking sector that has started since the sudden collapse of Silicon Valley Bank in March.

First Republic reported last week that deposits tumbled more than 40% in the first quarter, triggering further declines in the already struggling stock. Shares have cratered 97% since the start of the year. The stock is halted for trading as of Monday.

Investors are looking to several big-name companies releasing their earnings this week. Tech giant Apple and other headliners Qualcomm and AMD are scheduled to announce their quarterly results. First Republic’s demise and any potential fallout adds to the tension ahead of the Fed’s interest rate decision on Wednesday. The central bank is largely expected to hike one more time before pausing.

CHART OF THE DAY

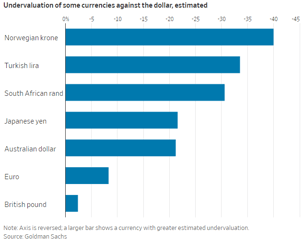

The U.S. economy no longer looks so exceptional. That is bad news for the dollar that is currently as much as 15% overvalued after a decade long rally. The greenback has fallen about 8.6% from a peak in September, as tracked by the WSJ Dollar Index, and is experiencing its worst start to the year since 2018. Investors are betting the U.S. currency has further to fall as the Federal Reserve nears the end of its most aggressive program of interest-rate increases since the 1980s. Also weighing on the dollar: concerns over the banking system, a potential U.S. debt default, and expectations, shared by many economists, that the U.S. will slip into recession in the coming months.

Still, a weaker dollar is typically good news for the global economy. It lowers the cost of servicing or repaying dollar debt for foreign companies and governments, boosts the value of overseas earnings by U.S. multinationals and can bolster global trade, because goods priced in dollars become more affordable to international buyers. “It’s a release valve for global growth,” said Nick Wall, head of global foreign-exchange strategy at J.P. Morgan Asset Management. “Sixty percent of global liabilities are denominated in dollars; a lot of those are in emerging markets, and emerging markets are responsible for maybe two-thirds of global growth in the last decade.”