Welcome to MarketBites! Here's all you need to know about yesterday's market news.

“Hard work spotlights the character of people: some turn up their sleeves, some turn up their noses, and some don’t turn up at all."

- Sam Ewing

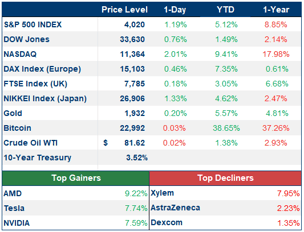

MARKET PERFORMANCE

PORTFOLIO MANAGER COMMENTARY

Stocks rose Monday as investors contemplated a potential slowdown in interest rate hikes from the Federal Reserve and braced for a busy week of earnings. The Nasdaq surged up 2.01% to lead the major indices.

Shares of Tesla and Apple gained on hopes that a reopening in China would boost their businesses. Both big tech names recently grappled with temporary shutdowns and blows to production as the country dealt with surging Covid-19 cases. Semiconductor stocks also had a good day with the VanEck Semiconductor ETF surging 4.7% for its best day since November.

Earnings reports could keep the market on edge this week, with about 40% of the Dow scheduled to release their latest financial results and offer more insight into how companies are weathering inflation and interest rates. Some big names on deck include Microsoft, IBM, Tesla, Visa, and Mastercard.

CHART OF THE DAY

Market-based gauges of inflation expectations project the annual pace of rising prices will drop in the months ahead roughly as rapidly as during the recession that followed the 2008 financial crisis or when Fed Chairman Paul Volcker used double-digit interest rates to crush the soaring inflation of the late 1970s. Hopes for a quick return to 2% inflation have encouraged bets that the Fed will pause and even reverse its interest-rate increases this year.