Welcome to MarketBites! Here's all you need to know about yesterday's market news.

"Can anything be sadder than work left unfinished? Yes, work never begun."

-Christina Rossetti

PORTFOLIO MANAGER COMMENTARY

The market recorded a third straight quarterly loss for the first time since 2009, as stocks continued to sell off on Friday.

Friday's selloff could have stemmed from fresh inflation data that pointed to inflation accelerating even more than expected in August. The Federal Reserve's preferred inflation measure, Core PCE, increased 4.9% on a year-over-year basis, more than the 4.7% estimate and up from 4.7% the previous month. This puts the Federal Reserve in an even tougher position moving forward. If inflation won't start coming down, they will be forced to slow an already fragile economy even further.

Looking ahead, earnings season is around the corner. According to CNBC, the estimated earnings growth rate for all the companies in the S&P 500 index now stands at 2.9% and, if that turns out to be the actual number for the quarter, it will prove the slowest rate of expansion since the third quarter of 2020.

By Raymond Kanyo

Portfolio Manager

Carmax stock ($KRX) dropped 24.6% yesterday on its worst trading day in more than 20 years after missing earnings expectations by a significant margin.

CHART OF THE DAY

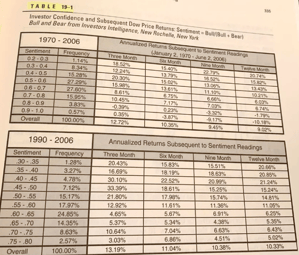

Based on history, when investor sentiment is the lowest (0.2), the market delivers the best results in the next 12 months. On the contrary, when investor sentiment is the highest (1), the stock market delivers the worst results in the next 12 months.

This is a great example of how emotional investors seem to get market risk backward. In reality, when the environment is the most negative, that is when stocks could be purchased for bargains and at low risk. On contrary, when sentiment is the best, that is when all asset prices are in a bubble and the risk is the highest as stocks have nowhere to go but down.

By Raymond Kanyo

PM

WHAT ELSE IS HAPPENING

- Three ways you can cash in on cash (read here)

- Facebook scrambles as users flee (read here)

- Rent drops after a two-year climb (read here)

- U.K. market turbulence challenges British businesses (read here)