Welcome to MarketBites! Here's all you need to know about yesterday's market news.

“I put my heart and my soul into my work, and have lost my mind in the process."

- Vincent Van Gogh

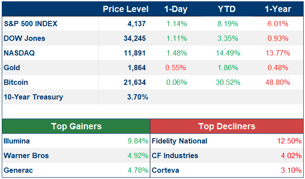

MARKET PERFORMANCE

PORTFOLIO MANAGER COMMENTARY

U.S. stocks rose on Monday as investors awaited inflation data, which will help them assess the direction of monetary policy. The Labor Department is set to release January's consumer-price index reading today, a closely watched measure of consumer spending. The market will be especially focused on core services inflation, which is affected by tight labor markets and higher wages.

Peter Garnry, head of equity strategy at Saxo Bank, says, "The key thing here is at what level will inflation begin to stabilize...if these inflationary factors are persistent, then the Fed will be in a position where they have to do more or keep rates up longer than the market is pricing." Jean Boivin, head of the BlackRock Investment Institute, says, "We're also looking for ongoing signs of economic damage in U.S. retail sales and industrial production." Retail sales figures, set to be reported on Wednesday, will provide clues on the health of the U.S. consumer. The headwinds surrounding inflation and economic growth could explain why despite this year's rally, investors have pulled a net $31 billion from U.S. equity mutual funds and exchange-traded funds in the past six weeks.

Several big companies, including AIG, Airbnb, Applied Materials, Cisco Systems, Coca-Cola, and Kraft Heinz, are due to report earnings later this week. So far this year, a higher-than-usual share of companies have missed consensus sales and profit forecasts.

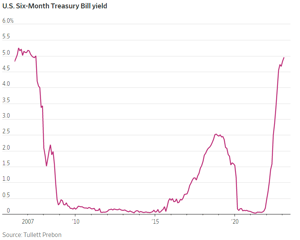

CHART OF THE DAY

Short-term Treasury yields continued to rise ahead of Tuesday's inflation data release. The yield on the six-month bill reached 4.947%, the highest since 2007. This is due to worries that the Federal Reserve will need to continue raising interest rates, causing the Treasury yield curve to invert to its widest in decades, a commonly observed recession indicator.

WHAT ELSE IS HAPPENING

- IPO darling, Palantir, pops on earnings report - read here

- Amazon Robo-taxi rollout - read here

- Super Bowl sports betting hits record - read here