Welcome to MarketBites! Here's all you need to know about yesterday's market news.

"If you don’t love something, you’re not going to go the extra mile, work the extra weekend, challenge the status quo as much."

-Steve Jobs

PORTFOLIO MANAGER COMMENTARY

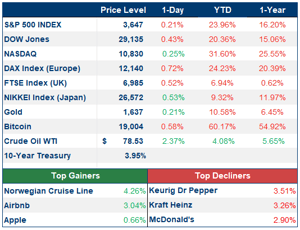

The S&P 500 and Dow fell deeper into bear market territory on Tuesday, while the 10-year Treasury yield continued to climb to levels not seen in the last decade. The Nasdaq was the only index managing to finish positive, rising 0.25%. Meanwhile, the S&P 500 dropped 0.21% and the Dow fell 0.43%.

Stocks got an initial boost after the Chicago Fed President Charles Evans signaled some nervousness about the central bank raising rates too quickly. These comments contrasted with other Fed officials who have recently backed the central bank’s hawkish stance with no hesitation.

The pound was rising more than 1% against the US dollar at one point early in the day before coming down to just a 0.4% gain at about $1.07.

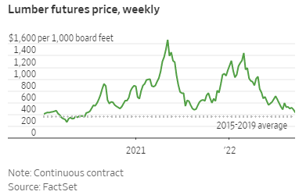

CHART OF THE DAY

Lumber prices have officially fallen back down to their pre-Covid levels at just above $410 per thousand board feet. Wood had been one of the pandemic's hottest commodities and recent interest rate rises have brought the price back down. Prices for wood had initially crashed during the pandemic when everyone was on lockdown. Then, after the initial crash, prices had exploded due to mass numbers of stuck-at-home Americans remodeling and buying suburban homes causing two-by-four prices to nearly triple the pre-pandemic record.

Investment Analyst

WHAT ELSE IS HAPPENING

- Pipeline sabotage? - (read here)

- CEO behind the collapsed cryptocurrency pair Terra and UST on the run - (read here)

- Update on EV tax credits - (read here)