Welcome to MarketBites! Here's all you need to know about yesterday's market news.

"A hero is someone who has given his or her life to something bigger than oneself."

- Joseph Campbell

PORTFOLIO MANAGER COMMENTARY

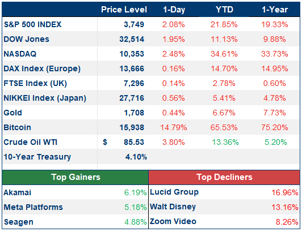

Stocks mounted their biggest rally since 2020 after October’s reading of consumer prices raised investor hopes that inflation has peaked.

Investors had been on the lookout for evidence that the Federal Reserve's interest-rate increases are tamping down price pressures. They liked the latest data: All three U.S. indexes had their best days since 2020. Treasury yields plunged after the CPI report, with the 10-year Treasury yield falling roughly 30 basis points to 3.824% as traders bet the Federal Reserve would slow its aggressive tightening campaign that’s weighed on markets all year.

Still, famed investor Carl Icahn says this rebound does not change his negative view on the market. He believes a recession is still on the horizon.

Investment Analyst

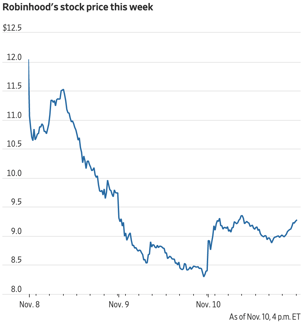

CHART OF THE DAY

This week, Robinhood's stock has tumbled, losing 32% through Wednesday, due to uncertainty surrounding the fate of Sam Bankman-Fried's investment as the crisis at FTX and crypto trading firm Alameda research has grown. His Robinhood investment is now worth about $473 million. Robinhood has no direct exposure to cryptocurrency exchange FTX or Alameda Research, said Vlad Tenev, chief executive of the popular trading platform.