Welcome to MarketBites! Here's all you need to about yesterday's market news.

"I am not afraid of tomorrow, for I have seen yesterday and I love today!"

- William Allen White

PORTFOLIO MANAGER COMMENTARY

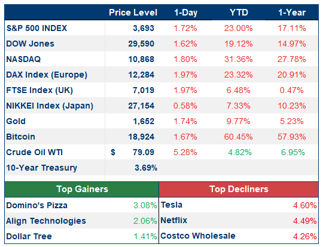

Stocks tumbled on Friday to close out the week as surging interest rates and foreign currency turmoil heightened fears of a global recession. The Dow set a new low for 2022 falling 1.61% on Friday. The S&P and Nasdaq are also nearing year lows dropping 1.72% and 1.80%, respectively. Goldman Sachs cut its year-end S&P 500 target due to rising rates, predicting at least a 4% downside from here. Energy was the worst performing sector down more than 9% as oil prices slump

“The market has been transitioning clearly and quickly from worries over inflation to concerns over the aggressive Federal Reserve campaign,” said Quincy Krosby of LPL Financial. “You see bond yields rising to levels we haven’t seen in years — it’s changing the mindset to how does the Fed get to price stability without something breaking.”

The British pound fell 3% against the USD Friday, setting a fresh three-decade low. This comes after a program of sweeping tax cuts was unveiled in the House of Commons.

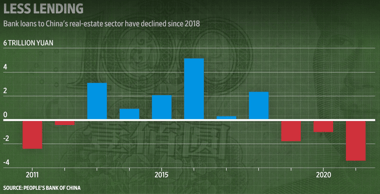

CHART OF THE DAY

China's economy has suffered recently missing forecasts by significant amounts. While China's 2nd quarter GDP tends to grow around 6.5% year over year, it was forecasted to grow at a slower rate of 1% year over year. Still, China's GDP growth missed this estimate and only managed 0.4% yearly growth. A big factor in this slowdown can be attributed to the real estate sector. China has seen a large decline in bank loans causing the real estate market to suffer. With less real estate demand, there has been a large drop in demand for raw materials sending shockwaves through China's economic growth.

Investment Analyst

WHAT ELSE IS HAPPENING

- Ford can't find its blue oval badges - (read here)

- Netflix is cutting smaller checks for comedy specials - (read here)

- "Don't equate fun with money", says Google CEO - (read here)

- A look into Costco's value - (read here)