Welcome to MarketBites! Here's all you need to know about yesterday's market news.

“If you try to do everything, you won’t do anything.”

- Tom Rath

PORTFOLIO MANAGER COMMENTARY

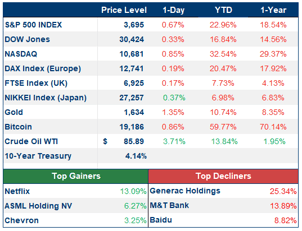

Stocks snapped a two-day winning streak amid a sharp rise in Treasury yields. Although earnings season is off to a good start, the high Treasury yields suggest recession fears are still intact. The 10-year yield traded as high as 4.14%, the highest level since July 23, 2008.

Netflix ended the day finishing up 13% following their strong earnings report Tuesday. United Airlines also performed well, rising 5% after beating estimates. The airline emphasized how resilient travel demand will help drive profit through the end of the year. Tesla reported their quarterly earnings after hours and captured a near-record quarterly profit amid growth concerns for the company. Still, their quarterly revenue of $21.5 billion is a record for Tesla, up from around $13.8 billion in last year’s third quarter. Even with these record numbers, the estimates were missed and sent the stock down 4% after-hours.

Investment Analyst

CHART OF THE DAY

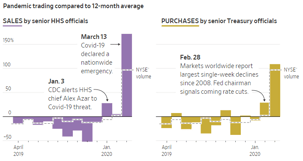

Federal officials working on the government response to Covid-19 are under scrutiny for 'exquisite timing' of their stock trades. Some sold in January 2020 when the government began mobilizing against the threat while others bought shares as a market-rescue plan was taking shape.

By Raymond Kanyo

Investment Analyst