Welcome to MarketBites! Here's all you need to know about yesterday's market news.

"The reward for work well done is the opportunity to do more.”

- Jonas Salk

PORTFOLIO MANAGER COMMENTARY

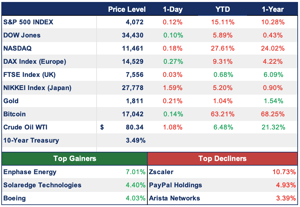

Stocks cut much of their earlier losses Friday as investors looked past hotter-than-expected labor data to the upcoming Federal Reserve meeting. All three indexes set weekly gains, with the Nasdaq posting the largest increase at nearly 2.1%. The S&P 500 added 1.1%, and the Dow ticked up by 0.2%. Friday’s close marked the first time the three major indexes notched back-to-back weekly gains since October.

Stocks dipped after labor data released Friday morning showed payrolls rose by 263,000 in November, a bigger gain than the 200,000 increase expected by economists polled by Dow Jones. Average hourly earnings also came in above expectations, jumping 0.6% compared with the prior month and 5.1% against the same month a year ago. The unemployment rate held steady at 3.7%.

CHART OF THE DAY

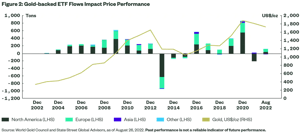

The recent strength of the US dollar in 2022 has not scared away gold demand. While the price of gold in USD terms year to date has seen a comparative drop from 2021, gold ETFs have posted US$14B in inflows globally, indicating that investors likely have purchased gold for portfolio diversification. US investors have added the most capital into gold-backed ETFs, equating to 83.7 metric tons (t) followed by the UK with 47.6t, Germany with 28.2t, and France with 9.5t. Geopolitical instability, high inflation, and economic uncertainty continued to support gold across Europe and Asia. Strong demand from those regions where the local currency continues to reach decade lows versus the US dollar reaffirms gold’s potential function for wealth-preservation and a “currency of last resort” globally.