Welcome to MarketBites! Here's all you need to know about yesterday's market news.

"No one can make you feel inferior without your consent.”

- Eleanor Roosevelt

PORTFOLIO MANAGER COMMENTARY

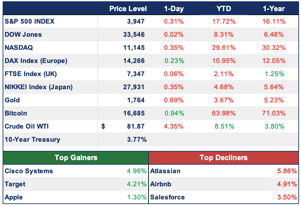

The indices all dropped on Thursday while bond yields jumped. The policy-sensitive 2-year Treasury yield jumped to 4.47%. These results come as Federal Reserve officials signaled their rate-hiking campaign to slow inflation is far from over.

St. Louis Fed President James Bullard said interest rates have to rise higher to restrict the economy to an extent that brings inflation back to the Fed’s target. He did not say a specific number, but a chart accompanying his remarks suggested the Fed’s policy rate could rise to a range between 5% and 7%. The Fed this month raised its target rate to a range of 3.75% to 4%.

Cisco Systems surpassed expectations in its fiscal first-quarter report and issued upbeat guidance. Cisco's share price rose 4.96% on the day. Other tech stocks such as Apple, up 1.30%, and Intel, increasing 1.22%, also led gains.

Investment Analyst

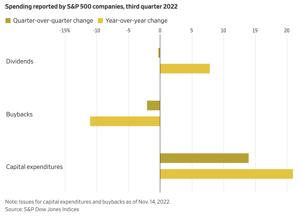

CHART OF THE DAY

Despite persistent worries about a potential recession, large U.S. companies are still spending more on capital projects, putting expenditures on pace to set a quarterly record. Capital spending among companies in the S&P 500 in the third quarter is set to top $200 billion, according to S&P Dow Jones Indices. Some investors say they are looking for companies that can keep low expenditures that will pay rewards in the short term. Furthermore, they hope these companies would be well-positioned to gain market share and emerge from a potential recession in a better shape than their peers.