Welcome to MarketBites! Here's all you need to know about yesterday's market news.

“Success is not final; failure is not fatal: It is the courage to continue that counts."

- Samuel Johnson

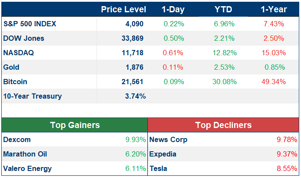

MARKET PERFORMANCE

PORTFOLIO MANAGER COMMENTARY

Stocks saw a volatile day on Friday as investors struggled with conflicting signals about the direction of the economy. The S&P 500 initially fell in early trading but managed to inch up before moving in a tight range for the rest of the day. It finished the day with a 0.2% increase but still posted a 1.1% weekly decline, its worst performance so far this year. This marks the first time that all three major indexes have finished the week lower since December.

The strong jobs report from last week, which showed the US adding 517,000 jobs and the unemployment rate falling to 3.4%, has created uncertainty for investors. A robust labor market could encourage the Federal Reserve to keep interest rates higher for longer to curb inflation. This, in turn, has led to a shift in expectations for interest-rate policy, with investors scaling back their bets on the Fed cutting rates this year. The yield on the benchmark 10-year Treasury note rose to 3.743%.

Oil prices were boosted by Russia's announcement of a 500,000 barrel per day cut in output starting in March. Russia's move serves as retaliation against Western sanctions and military support for Ukraine. Global crude benchmark Brent climbed 2.2% to $86.39 per barrel.

CHART OF THE DAY

The average investor holds onto a stock for about 10 months, signaling that short-term thinking remains prevalent in equity markets.

WHAT ELSE IS HAPPENING

- U.S. military shoots down another object in American air space - read here

- Russia cuts oil output - read here

- You can now invest in an ETF that tracks the trades of politicians - read here