Welcome to MarketBites! Here's all you need to about yesterday's market news.

"Every new beginning comes from some other beginning’s end."

- Seneca

PORTFOLIO MANAGER COMMENTARY

PORTFOLIO MANAGER COMMENTARY

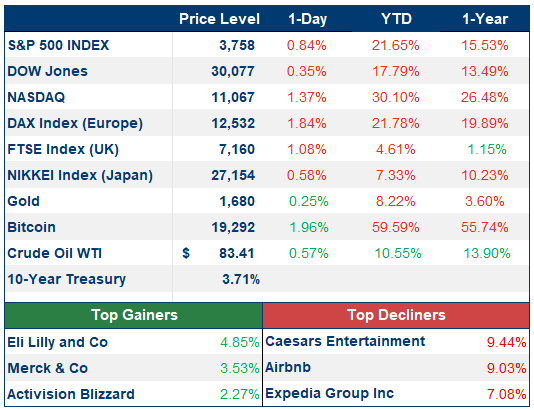

Stocks fell for the third straight day Thursday following the Fed’s aggressive rate hike. Investors have an increasing fear that these rate hikes will send the economy into a recession. This caused the S&P 500 to drop 0.84%, the Nasdaq to fall 1.37%, and the Dow to finish down 0.35%. As stocks keep dropping, bond yields continue to see new highs.

Other central banks worldwide have been following the Fed’s lead by implementing their own sizable rate hikes, despite repercussions to their economy. The Bank of England raised its key interest rate for the 7th consecutive time Thursday. On the contrary, the Bank of Japan kept their rates steady, opting for government intervention instead. Japan’s government intervened for the first time in 24 years to sell dollars and buy yen to slow the recent fall in Japanese currency.

Eli Lilly shares rallied 4.85% upon an upgrade from UBS. Analysts claim saying the weight loss drug they are developing could be ‘the biggest drug ever’. Boeing, on the other hand, is poised to pay $200 million to settle an SEC investigation into allegedly misleading statements the company made about the 737 MAX jets that crashed in Indonesia and Ethiopia.

CHART OF THE DAY

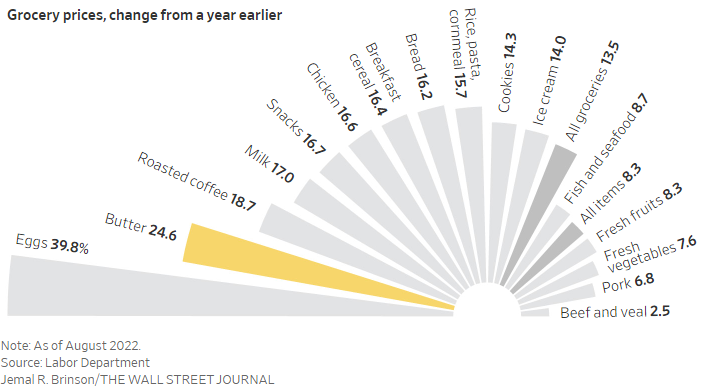

.U.S. grocery prices in August rose 13.5% during the previous 12 months, the largest annual increase since 1979, according to the labor department. Economic pressures forcing high prices for livestock feed, labor shortages, and other factors could persist and keep prices for kitchen staples elevated longer term. Butter has been one staple in particular seeing higher prices due to lower milk production and labor shortages at processing plants.

Investment Analyst

WHAT ELSE IS HAPPENING

- FedEx raises prices to combat low demand - (read here)

- Does Bed Bath & Beyond have any hope? - (read here)

- Amazon’s unethical trucking decisions - (read here)

- Rate impact home-buying power - (read here)

By Kevin Hurley

By Kevin Hurley