Welcome to MarketBites! Here's all you need to about yesterday's market news.

Quote of the day:

"We must embrace pain and burn it as fuel for our journey."

- Kenji Miyazawa

PORTFOLIO MANAGER COMMENTARY

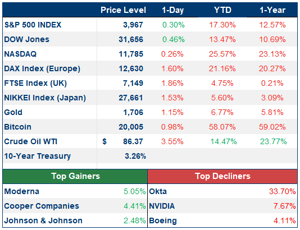

The S&P 500 and Dow Jones Index ended the first day of September on a high note snapping their four-day losing streak. The S&P was able to climb 0.30% and the Dow managed a 0.46% increase. Meanwhile, the Nasdaq fell -0.26% to post its first five-day losing streak since February. The indexes are still all on track to finish this week lower.

The 2-year U.S. Treasury yield topped 3.5% Thursday which is its highest level since November 2007.

Chip stocks, such as NVIDIA and AMD, had a rough day yesterday after the U.S. announced limits on exports to China. NVIDIA stock tumbled down -7.67% Thursday following the news.

The health of the labor market will be on full display today as the jobs report comes out. Investors have been waiting all week for this since it will hint at the future path of Fed policy.

CHART OF THE DAY

The U.S. dollar has strengthened to 20-year highs as the Fed continues its aggressive interest rate hikes. This is not necessarily good news, especially for multinational companies.. Still, the strength of the U.S. dollar has allowed American buyers to splurge on European homes.

Investment Analyst

WHAT ELSE IS HAPPENING

- Amazon's solar fiasco - (read here)

- Mortgage rates rise to 5.56% - (read here)

- Blackstone, Carlyle look at energy differently - (read here)

- America's potential gas crisis - (read here)