Welcome to MarketBites! Here's all you need to know about yesterday's market news.

“If you do not change direction, you may end up where you are heading."

-Lao Tzu

.png?width=304&height=236&name=image%20(4).png)

PORTFOLIO MANAGER COMMENTARY

Stocks rose Friday after another volatile trading session. Even though Friday began with fears that the banking crisis was spilling over to Deutsche Bank, the markets rebounded to end the week on a higher note. The major indexes all had a winning week, with the Dow gaining 0.4% week-to-date as of Friday afternoon, while the S&P 500 and Nasdaq gained 1.4% and 1.6%, respectively.

A selloff of Deutsche Bank shares was triggered after the German lender's credit default swaps jumped, but without an apparent catalyst. The move appeared to raise concerns once again over the health of the European banking industry. Earlier this month, Swiss regulators forced a UBS acquisition of rival Credit Suisse. Deutsche Bank shares traded off their worst levels of the session, which caused major U.S. indexes to also cut their losses.

European Central Bank President Christine Lagarde tried to ease concerns, saying euro zone banks are resilient with strong capital and liquidity positions. Lagarde said the ECB could provide liquidity if needed.

One factor that helped the market was a bounce back in regional bank stocks. The sector rallied on Friday, with the SPDR S&P Regional Banking ETF gaining 3.01% during the trading session. Amid all the volatility, the KRE ended the week up 0.18%. “I think that the market overall is neither frightened nor optimistic — it’s simply confused,” said George Ball, president at Sanders Morris Harris. “The price action for the last month-and-a-half, including today, is a jumble without any direction or conviction.”

CHART OF THE DAY

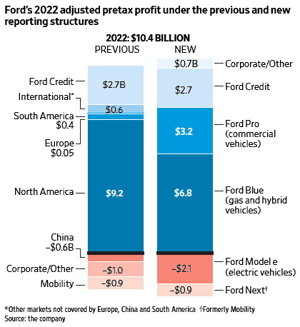

Historically, Ford has reported profit-and-loss by regions. Now it will break out results for each of the three new business units, rather than providing regional results.

The Model e electric-vehicle division’s losses grew to $2.1 billion last year, from $900 million the year before. Ford Motor Co. expects to lose about $3 billion on its electric-vehicle business this year. Ford finance chief John Lawler attributed the mounting losses to investments Ford is making to increase EV production in coming years, including construction of two new battery-cell factories in Kentucky and a third in Tennessee, along with a new plant to make EV trucks. The traditional Ford Blue business, dominated by sales of its highly profitable F Series pickup trucks, posted operating profit of $6.8 billion last year, more than double that of 2021, when a semiconductor shortage hurt vehicle output.

WHAT ELSE IS HAPPENING

- Here's what retirement looks like with less than $1 million in the U.S. - read here

- Blue Origin says an overheated engine part caused last year's cargo rocket failure - read here

- British Museum holds line on its imperial loot - read here