Welcome to MarketBites! Here's all you need to know about yesterday's market news.

"There is no limit to what a man can do or where he can go if he doesn't mind who gets the credit.”

- Ronald Reagan

PORTFOLIO MANAGER COMMENTARY

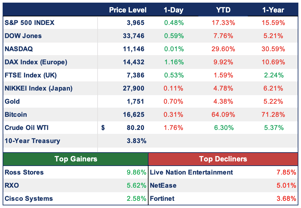

The major averages ticked higher in afternoon trading Friday to end the day on an upbeat note as investors assessed tougher language from Federal Reserve speakers and pored over the latest earnings reports. The S&P 500 gained 0.5%, while the Nasdaq Composite edged ahead less than 0.1%. The Dow Jones Industrial Average ticked up 0.6%. All of the major averages posted losses for the week. The Dow ended 0.01% lower. The S&P 500 lost 0.69% for the week, while the Nasdaq ended 1.57% lower. All three indexes are positive for the month, however.

On Friday, Boston Federal Reserve President Susan Collins expressed confidence that policymakers can tame inflation without doing too much damage to employment.

“We continue to think investors should place much more emphasis on the actual data and not focus too much on Fed rhetoric (the former will show where inflation is headed while the latter is fixated on where it was),” said Adam Crisafulli, founder of Vital Knowledge. “That said, investors are tired of battling the Fed’s daily tape bombs and the fear is it may take 2-3 more CPIs for officials to stop admonishing the market every time it tries to rally.”

Investment Analyst

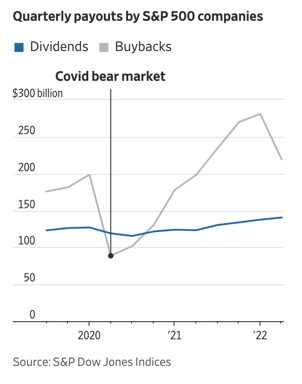

CHART OF THE DAY

Buybacks lower share counts and boost per-share earnings. Since companies get more bang for their buyback buck when stock prices are lower, one might think that this year’s bear market would have further loosened corporate cash spigots, even without the urgency created by a tax deadline. But companies are generally not great market timers. Take Facebook parent Meta Platforms, one of the largest buyers of its own stock in recent years. In the 12 months through September, Meta bought back a whopping $48 billion of its own stock at an average of $304 a share. Its stock price is now just $111, and last week Meta announced it would lay off 11,000 employees to save money.