Welcome to MarketBites! Here's all you need to know about yesterday's market news.

“We all have routines. They can be productive or they can be poisonous."

- Cameron Hanes

.png?width=300&height=226&name=image%20(19).png)

PORTFOLIO MANAGER COMMENTARY

The Dow finished April 2.5% higher, its best monthly showing since January, when the average ended up 2.8%. The S&P 500 logged a 1.5% monthly gain — its second positive month in a row — while the Nasdaq ended the month only slightly higher. On a weekly basis, the Nasdaq saw the largest gain, at 1.3%, in what was considered Big Tech’s marquee earnings week. The Dow and S&P 500 each finished the week about 0.9% higher.

Exxon Mobil and Chevron collectively posted $18 billion in first-quarter profits, showing resilience even as oil and natural-gas prices declined. The Western world’s largest oil companies rocketed to record earnings last year as energy prices soared following Russia’s invasion of Ukraine. The results amounted to a first-quarter record for Exxon. Even so, both companies’ earnings were off more than 40% of the record high quarterly profits they reached last year.

The Federal Reserve’s banking supervisors failed to take forceful action to address growing problems at Silicon Valley Bank before it collapsed last month, the central bank’s top regulator said, signaling a broad push to toughen rules on the industry. Michael Barr, the Fed’s vice chair for supervision, said supervisors didn’t fully appreciate the extent of the vulnerabilities as SVB grew in size and complexity. When supervisors did find risks, they didn’t take sufficient steps to ensure the firm fixed those problems quickly enough, he said in a report Friday.

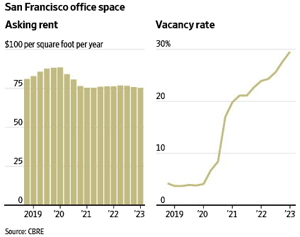

CHART OF THE DAY

Nearly 30% of San Francisco’s office space is vacant, more than seven times the rate before the pandemic hit, and the biggest increase of any major U.S. city, according to commercial real estate services firm CBRE Group Inc. It is hard to know just what office buildings in San Francisco’s financial district are worth, because transactions have practically dried up.