Welcome to MarketBites! Here's all you need to know about yesterday's market news.

“Always concentrate on how far you’ve come, rather than how far you have left to go."

- Unknown

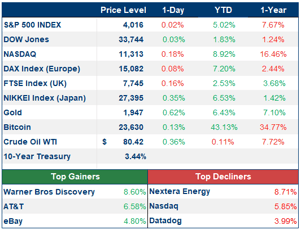

MARKET PERFORMANCE

PORTFOLIO MANAGER COMMENTARY

The Nasdaq closed lower Wednesday for a second day as investors studied the latest batch of corporate earnings, and assessed how the largest companies are faring amid rising rates and heightening recession fears. Technology stocks languished for most of the session after Microsoft’s lackluster guidance further fueled growth concerns. The software giant closed slightly lower. Boeing finished slightly higher despite a top-and-bottom-line miss.

“If the company is bearish on its own future, why should investors be bullish? That’s pretty much the message we’re getting from earnings season so far,” said Adam Sarhan CEO of 50 Park Investments. Through Wednesday’s open, more than 19% of S&P 500 companies have reported fourth-quarter earnings, with 68% of them posting stronger-than-expected results, according to FactSet.

This beat rate, however, lags historical trends, according to The Earnings Scout CEO Nick Raich. The average beat rate for fourth-quarter earnings is 79%, he pointed out in a Friday note.

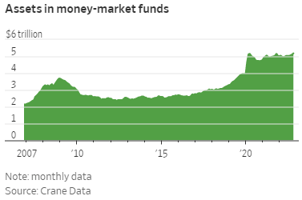

CHART OF THE DAY

Wall Street is currently pouring their money into cash. Investors have added about $135 billion to global money-market funds over the past four weeks, according to EPFR data through Jan. 18. A money-market fund is a form of mutual fund that invests in short-term debt securities including Treasury bills and commercial paper. Companies and consumers often use them like checking accounts to store their ready cash. The increased cash allocation is a notable sign of caution as we head deeper into 2023.

WHAT ELSE IS HAPPENING

- Southwest Airlines earnings hit by holiday meltdown - read here

- Dow to cut 2,000 jobs globally - read here