Welcome to MarketBites! Here's all you need to know about yesterday's market news.

“Those who make the worst use of their time are the first to complain of its brevity."

- Jean de La Bruyere

MARKET PERFORMANCE

.png?width=301&height=226&name=image%20(1).png)

PORTFOLIO MANAGER COMMENTARY

Stocks closed higher on Monday as traders grew hopeful that a crisis in the banking sector may be easing. The gains followed a forced takeover of Credit Suisse by UBS engineered by the Swiss government. Regional banks rose on Monday, rebounding from big losses in the past week. Wall Street expects more action may be needed to restore confidence in the banking system after U.S. regulators backstopped SVB’s uninsured deposits and offered new funding for troubled banks.

The instability in the financial sector over the past two weeks has raised the stakes for the Fed's interest rate decision coming tomorrow. As of Monday, there was about a 73% chance of a quarter-point increase. The other 27% is the no-hike camp who anticipate a less aggressive tightening campaign in the face of emerging financial contagion.

“We’re still not feeling the full effects [of the rate hikes]. Regional banks, which account for maybe around a third of all lending in the United States, [are] now going to have to pull back on lending to shore up their balance sheet,” said Eric Diton, president and managing director of The Wealth Alliance.

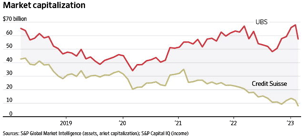

CHART OF THE DAY

UBS agreed to take over its longtime rival Credit Suisse for $3.2 billion, pushed into the biggest banking deal in years by regulators eager to halt a dangerous decline in confidence in the global banking system. The deal between the two Swiss finance behemoths is the first megamerger of systemically important global banks since the 2008 financial crisis. The urgency on the part of regulators was prompted by an increasingly dire outlook at Credit Suisse. The bank faced as much as $10 billion in customer outflows a day last week, according to a person familiar with the matter. A forced marriage of the two titans was something UBS had never wanted. Credit Suisse had its scandals, and its big invest-exist ment bank was the opposite of UBS’s model built around managing the finances of rich clients. But other parts of the deal were attractive, as Credit Suisse is UBS’s chief rival in the Swiss banking system.

WHAT ELSE IS HAPPENING

- JPMorgan CEO Jamie Dimon leads efforts to craft new First Republic Bank rescue plan - read here

- China's Xi meets with Putin in Moscow - read here

- Amazon to cut 9,000 more jobs - read here