Welcome to MarketBites! Here's all you need to know about yesterday's market news.

“The secret of success is to do the common thing uncommonly well."

- John D. Rockefeller Jr.

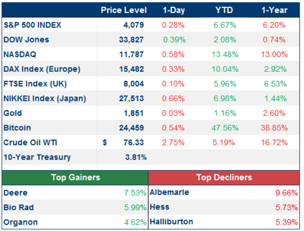

MARKET PERFORMANCE

PORTFOLIO MANAGER COMMENTARY

US stocks fell for a second day in a row, with the S&P 500 down 0.3% and the tech-heavy Nasdaq Composite falling 0.6%. However, the Dow Jones Industrial Average opened lower but recovered to close higher, up 0.4%. Government-bond yields rose for a fourth consecutive week to 3.827%, marking the biggest gains since October, which suggests that investors are becoming more wary of interest rate hikes.

The Fed has set a 4.5% to 4.75% target range for its short-term rate, and two Fed officials have said they supported a larger rate increase than the quarter-percentage-point increase implemented at the February meeting, which may signal a change in the central bank’s policy. Inflation data and commentary from Fed officials this week have dampened the optimism among investors, and some are concerned that there will be “no landing” instead of a soft landing or recession, which means inflation would remain high, and the Fed would push interest rates much higher.

Bitcoin retreated following three days of gains after the US Securities & Exchange Commission accused Do Kwon and Terraform Labs of fraud over the wipeout of digital currencies he created. In commodities, oil headed for its longest string of daily losses on the year due to rising US inventories and the prospect of further tightening by the Federal Reserve, which overshadowed the lift from more signs that Chinese energy demand is improving.

In corporate news, Moderna's shares declined by 3.3%, after the company announced that its experimental flu vaccine had mixed results in a large clinical trial. DraftKings, on the other hand, saw its shares rise by 15% following the announcement of its quarterly results. Deere's stock climbed by 7.5% after the company posted strong earnings.

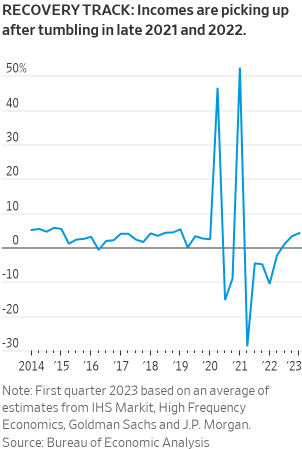

CHART OF THE DAY

New data in the US shows low layoffs and rising supplier prices, while pay raises and cost-of-living adjustments for retirees have lifted consumer purchasing power. The news has been bad for stocks, which fell over concerns that the Federal Reserve will have to keep interest rates high to combat inflation. However, economists predict that the positive trends in incomes will be a source of support for the economy, and this year could see workers being "made whole".

WHAT ELSE IS HAPPENING

- DraftKings stock surges after sports-betting company boosts outlook - read here

- It's richession, not a recession - read here

- The history of spy balloons, explained by an aeronautics expert - read here