Welcome to MarketBites! Here's all you need to know about yesterday's market news.

“Life doesn’t get easier or more forgiving, we get stronger and more resilient.”

- Steve Maraboli

PORTFOLIO MANAGER COMMENTARY

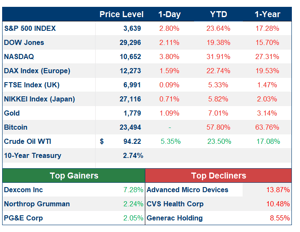

Market declines continued on a positive jobs report for September, but were still able to close the week up by about 1.5%. The S&P opened the day lower, but accelerated throughout, closing down about 2.8%, the Nasdaq tumbled 3.8%, and the Dow declined 2.11%. All major sectors traded lower, with technology leading the way, falling 4.27%. The best-performing sector was energy, falling only 0.77%. While adding jobs is generally seen as a good thing, the market reacted poorly due to the likelihood that the Fed will continue their interest rate hikes to combat inflation. The 2-year Treasury yield rose .06% to 4.316%

Oil traded higher on the day following OPEC+'s decision to cut supply. Brent Crude rose 3.7% to 97.91 per barrel. It should come as no surprise that this weeks top stocks include 3 energy names. Marathon, APA Corp, and Halliburton are all up more than 20% week to date.

Advanced Micro Devices (AMD) took a tumble after warning its Q3 2022 revenue would be lower than expected. Primary reasons for the warning are due to weaker PC demand, and continued supply chain issues. The company also reported that non-GAAP gross margins are expected to come in around 50% as opposed to the 54% earlier expectation. AMD is now trading at its lowest levels since July 2020.

Investment Analyst

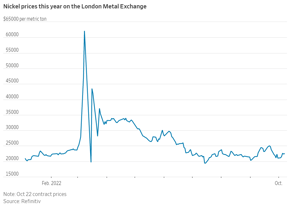

CHART OF THE DAY

Not all battery metals are doing well. Nickel's demand attributable to lithium is only 15% while 65% is used to produce stainless steel - closely tied to the global construction sector. This has caused the price of nickel to plummet sharply as the world nears closer and closer to recession. Indonesia, one of the world's largest suppliers of nickel, reported that production was up 27% year to date, further applying downward pressure to the price. Goldman expects demand from Europe's stainless steel sector to fall 30% through the rest of the year.

By Kevin Hurley

Investment Analyst

WHAT ELSE IS HAPPENING

- How to make peace with your stock market losses (read here)

- Stock funds down 24.8% in 2022 (read here)

- Long-term unemployment dips by another 70,000 people (read here)

- Citi makes the case for buying Meta as Reels monetization improves (read here)