Welcome to MarketBites! Here's all you need to about yesterday's market news.

Quote of the Day:

"If you are not willing to risk the usual, you will have to settle for the ordinary.”

- Jim Rohn

📝Daily Stock Market Thoughts

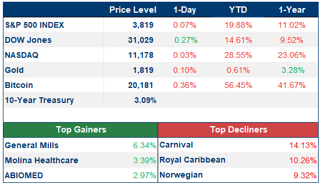

The stock market was rather directionless on Wednesday. Federal Reserve Chair Jerome Powell said that the U.S. is in "strong shape" and "well-positioned to withstand tighter monetary policy." He also reiterated his commitment to bringing down inflation, adding that the process could cause some pain.

Here are some fresh data points on the economy that go directly against Powell's upbeat attitude: Q1 personal consumption came in at 1.8% vs. 3.1% expected, while Q1 GDP was revised down to -1.6% from -1.5%. Also, a measure of sentiment among Chief Financial Officers has plummeted to the lowest in nearly a decade.

📊Chart Of The Day

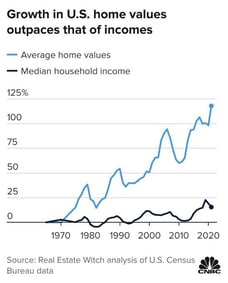

There has been nothing sustainable or rational about the housing market for 50 years. The housing market theoretically should rise by the level of inflation. The attractive returns in real estate come from the use of leverage (think how you can buy a house with 5% down and finance the rest with a mortgage loan). Either U.S. homebuilders are all colluding to limit the housing supply and thus artificially hike prices, or U.S. employers have been getting fleeced by their companies. I suppose it is possible that I am just irrational and this is actually sustainable, but that seems unlikely.

What Else Is Happening:

- Crypto hedge fund Three Arrows ordered to liquidate - (read here)

- Starz looks to acquire after Lionsgate spinoff - (read here)

- Chinese lithium giant set to IPO - (read here)

- Bed Bath & Beyond sinks further - (read here)